Reaching the SDG targets simply will not be possible without a strong and sustainable agriculture sector.

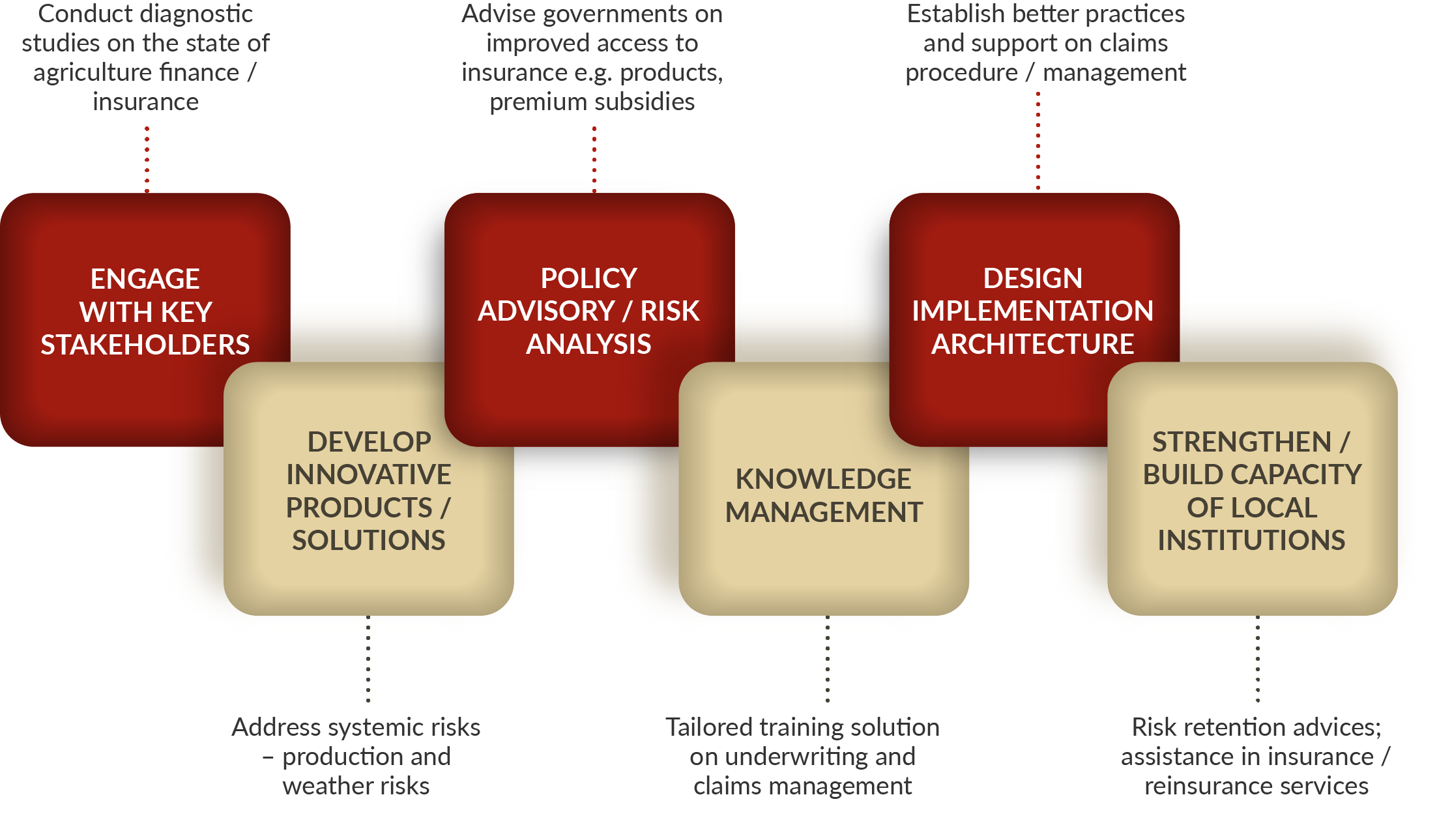

KMD partners with Governments, regulators, multilateral and bilateral aid agencies on policy framework such as increased access to credit, improved agriculture productivity, reduced vulnerability (insurance) and enhanced social protection.

KMD’s endeavour is to bridge the divide / gap between the world’s insurance markets and the most vulnerable, low-income people through relevant, inclusive and affordable insurance product(s)/ scheme(s).

KMD has developed markets for specific micro (mass) insurance products – covering the entire value chain from feasibility study, data sourcing, marketing support, education services, setting up pilot schemes and industrializing schemes for scale-up.

KMD advise governments, regulators and aid agencies on policies for agriculture insurance (e.g. financial incentives, premium subsidies, and the overall role of government to promote agriculture insurance) and on development of effective insurance products.

KMD’s consultancy services on the rural and micro insurance platforms is aimed at new product formulations, need assessment, comprehensive survey reports, project management, service delivery, claims servicing, negotiation of renewal terms and conditions, risk management and operational management solutions.

The team has unparalleled experience in ensuring that the insurance programs/ schemes are well accepted in terms of design and pricing by the clients, local insurers (underwriters) and the top reinsurers of the world. With the advantage of having worked with all the major reinsurance players, there is an extensive industry and (re)insurance market knowledge base throughout the team covering broking, placement, claims, market and technical support.

KMD is specialized in structuring and originating tailored insurance solutions to mitigate the effects of adverse weather, climate change and natural catastrophes.

The Climate Risk Adaptation and Insurance Department at KMD uses the principles of Human Centered Design to ensure the design of the insurance solutions (features and risk coverage) are needs – based, adjusted to the local content (especially the target segment) and linked to comprehensive risk management strategies. The broad objectives for using the HCD principles is to:

“Insurance” is one of the most effective and efficient risk transfer mechanisms for the farmers. The crop insurance scheme will help to soften the inevitable economic blow of natural disaster. KMD has structured climate risk insurance schemes to enhance famers resilience against shocks and build their assets steadily. Climate (Agriculture) risk insurance can play both adaptive and mitigative role and has three benefits:

Our Parametric insurance solutions can help in closing the protection gap

Parametric insurance is a non-traditional insurance product that offers pre-specified payouts based upon a trigger event. Weather is one of the simplest parametric triggers as data is readily available from independent third parties and accuracy is improving all the time. The combination of high-resolution satellite technology and more weather stations has made it possible for grids to be recalculated to a few meters square, providing a very high level of accuracy and reliability for farmers and their insurers, no matter how remote the location.

By its nature, parametric insurance brings with it the ability to provide rapid funding for relief, recovery and reconstruction efforts, and so may have the greatest potential impact in countries most dramatically affected by natural perils and where the protection gap is currently large.

Utility of Parametric Insurance Scheme:

KMD helps livestock farmers worldwide protect their assets from risks such as mortality, infertility, theft and disease. KMD use the know-how of industry experts, risk consultants and vets; to assess risks and design fairly priced products.

Utility of Livestock Insurance Scheme:

Our research has shown that providing climate information is one of the most effective ways to help farmers and other investors reduce their risk exposure to such conditions. In line with this, KMD works closely with local meteorological departments in producing four types of climate information — seasonal forecasts, 10-day forecasts, daily forecasts and instant forecasts for extreme events — which are helping farmers better adjust their agricultural management to respond to weather forecasts.

The lessons learnt from various markets are shared through thematic studies and briefing notes. These passive knowledge dissemination methods are complemented with efforts to proactively encourage the adoption of good practices across insurers and channel partners. We are likely to have greater success in changing behaviors and practices through interactive dissemination tools, including conferences and learning workshops at all levels (micro, meso and macro).